E-Invoicing means registering your invoice particulars on the Indian government’s Invoice Reference Portal (IRP). New GST laws stipulate that businesses with certain turnover have to upload their invoice and generate Invoice Reference Number (IRN) and Quick Response (QR) Code. This facilitates the exchange of data between the buyer and the seller.

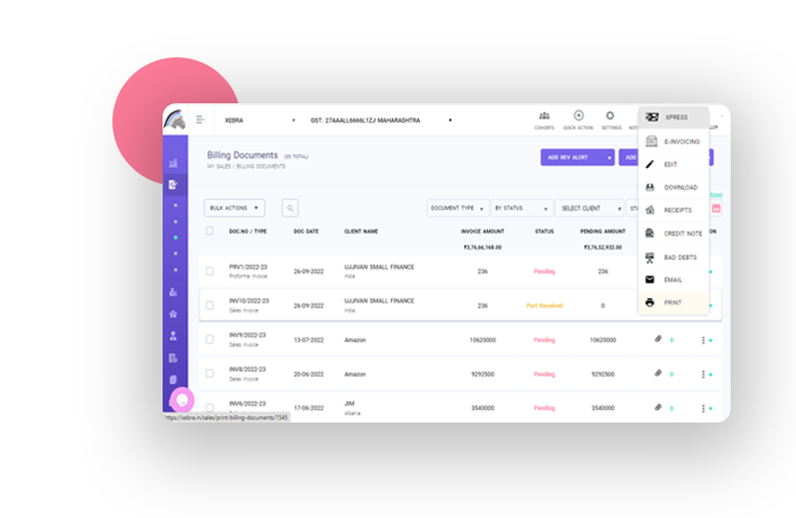

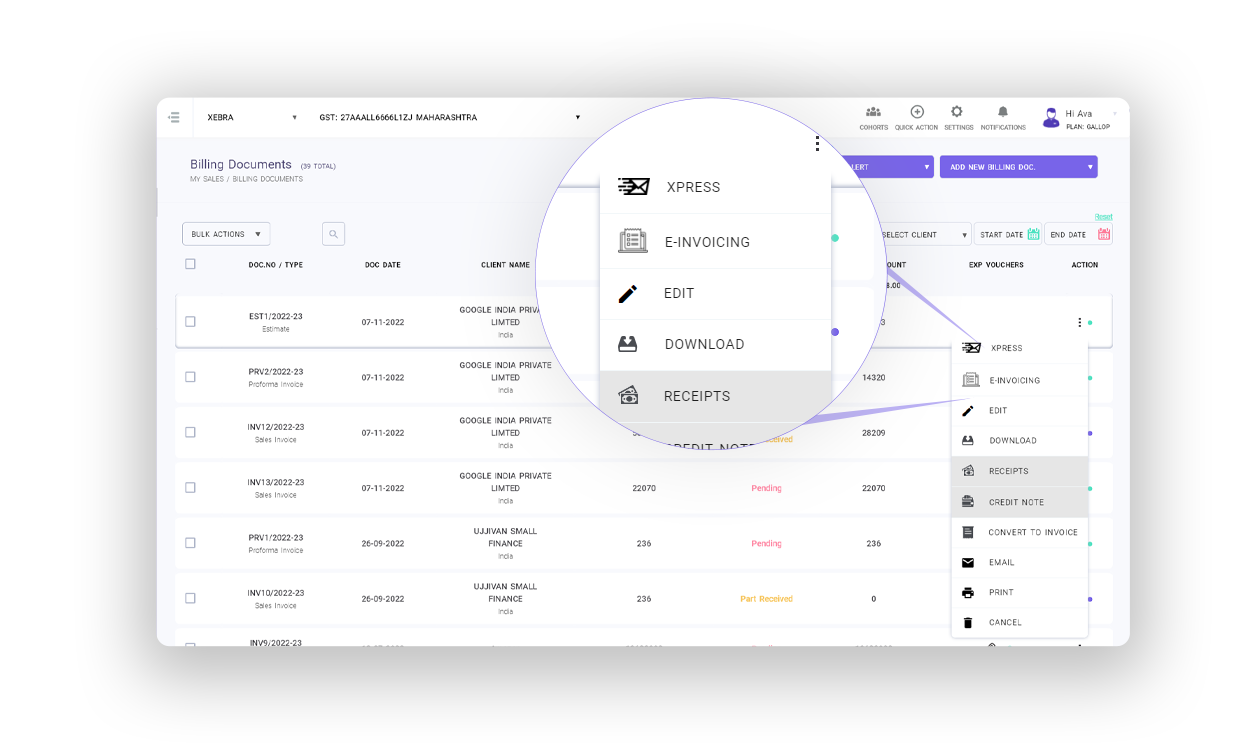

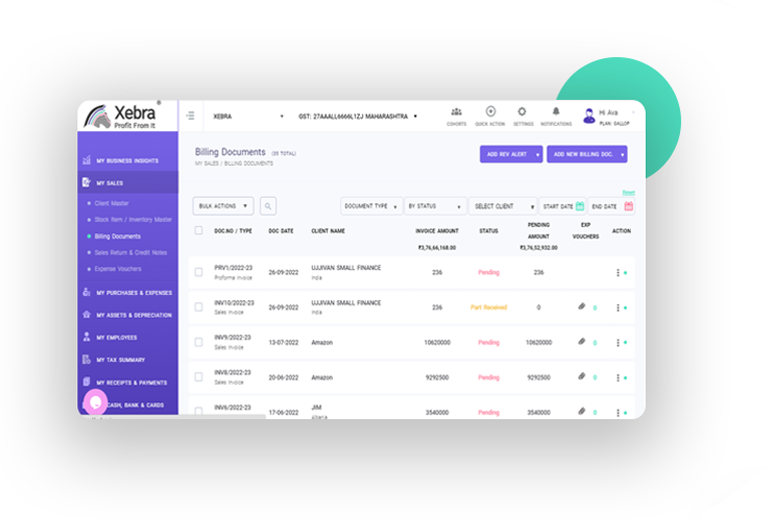

Send invoices to IRP with ease

Simple one-click feature to convert your invoice into an e-invoice by sending it to the IRP. Get an automated QR code and IRN number on your invoice