Seamless invoice integration

Auto-calculates the amount and integrates it with each invoice

Pass on the EL amount to your clients with seamless invoice integration

Track client-wise status of payment recoverable from them

Seamless calculation and integration of Equalisation levy with client-wise invoices. Easy tracking of the pending amount to avoid any penalty

Auto-calculates the amount and integrates it with each invoice

Pass on the EL amount to your clients with seamless invoice integration

Track client-wise status of payment recoverable from them

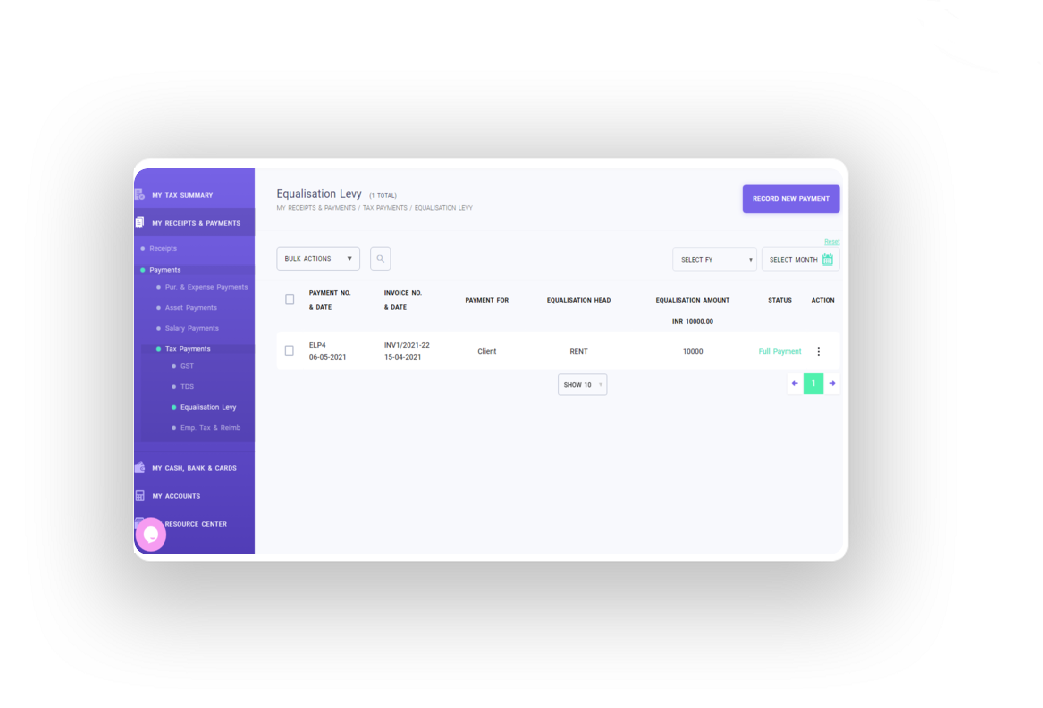

Track the EL deducted vendor-wise and make timeline payments

Auto-calculates the amount invoice-wise and month-wise

Save penalties with auto-reminders for monthly payments

Know the status of your Equalisation Levy payment for your company

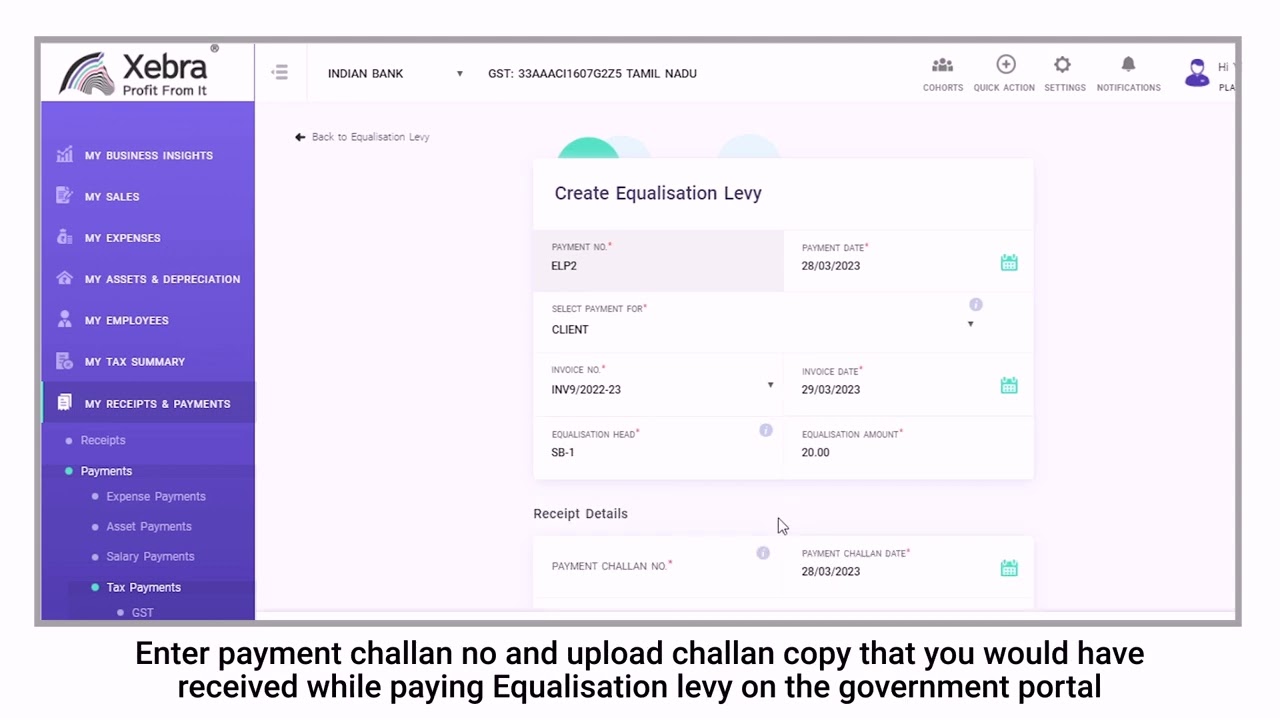

Reminders and notifications for monthly and annual payments

Upload Equalisation Levy challan copies with ease for future reference

Easily export data into excel or email to clients and vendors