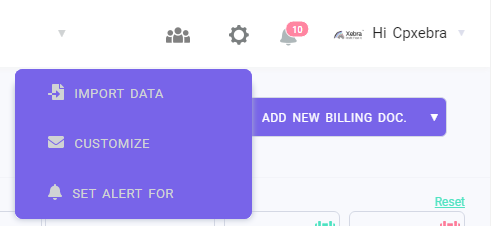

Invoicing is the starting point to capturing revenues of your company. It has a Business-Intelligence Assistant ‘Xebra®®’ that collates all your data and presents it in a manner that will help you take decisions. For e.g. which client is really the most profitable for you? What is the % contribution of one service over another? What is the average credit period that you are extending per client?

With Xebra®® as your assistant, you can

- Increase profitability with business reports

- Maximise revenues by detailed customer analysis

- Track & Reduce credit period to customers

- Timely alert on expiry of legal contract and PO to avoid delay in payment

- Understand client payment credit history for faster decisions