Xebra® shines at Maharashtra State Conclave

We are thrilled to announce that Xebra® was selected to participate in the prestigious Maharashtra State Conclave's start-ups programme. Organized by ESC and STPI, this event brought together 38 unique entrepreneurs to exhibit their products to top industr

Read More...

Empowering MSMEs: Xebra® joins Social Innovation Lab

We have an amazing platform to grow and improve our solutions for MSMEs thanks to the Social Innovation Lab programme. We interacted with fellow innovators, mentors, and executives in the business throughout three months, learning a great deal and developi

Read More...

Turn the Petty Cash chaos around.

Ever found yourself wrestling with the complexities of petty cash management? Fear not, for our ERP system, Xebra®, is here to transform your financial struggles into victories!

You know that feeling when petty cash becomes a puzzle, and you're left wonde

Read More...

6 Invoicing secrets you wish you knew

Xebra®, on the other hand, is the cream of the crop when it comes to invoicing software. It's like that dependable, experienced first mate you can always rely on. It's designed for small businesses like yours, with a user-friendly interface, mobility choic

Read More...

TDS asset mastery: Click, Win, Pay

Xebra® stands out as your go-to buddy for stress-free TDS management in a world where simplicity is a rare diamond. Say goodbye to tax-related difficulties and hello to a more efficient, simpler manner of managing your finances. Managing TDS has never been

Read More...

Ditch the numbers crunch, dance with Xebra®

Say goodbye to billing headaches and hello to the sweet melody of automation, courtesy of Xebra®'s scalable, user-friendly, and cost-effective features. Imagine a future where saving money is as simple as a tap on your tablet, and your financial path becom

Read More...

Navigating HR waters? Xebra's got the magic wand

Xebra® is the ringmaster of this cloud carnival, conducting a symphony of efficiency and creativity. So, if you're ready to transform your HR difficulties into "whoa!" moments, board the Xebra® cloud carousel, where HR dreams take flight!

Read More...

Embrace the cash flow groove

With Xebra®, you have a cash flow software that is more than just another alternative; it is the conductor of the financial orchestra. It is the best financial partner for small businesses like yours and mine, excelling at cash flow management and providin

Read More...

Elevate Your Business to New Heights with Xebra

Efficiency is critical in today's fast-paced business world. Small and medium-sized businesses require a complete software solution to smoothly handle their finances, client connections, and payroll. That is where Xebra® excels as the ideal ERP (Enterprise

Read More...

Experience inventory genius with Xebra®

In the fast-paced world of business, where every second counts, keeping a close check on your inventory is a must. That's where your trusted financial ally, Xebra®, comes in with its exceptional automation prowess.

Read More...

Experience billing excellence with Xebra®

An online billing software like Xebra® is a game changer for a wide spectrum of enterprises in today's digital world. Whether you're a startup, a small firm, or a major corporation, Xebra® can be a valuable financial resource.

Read More...

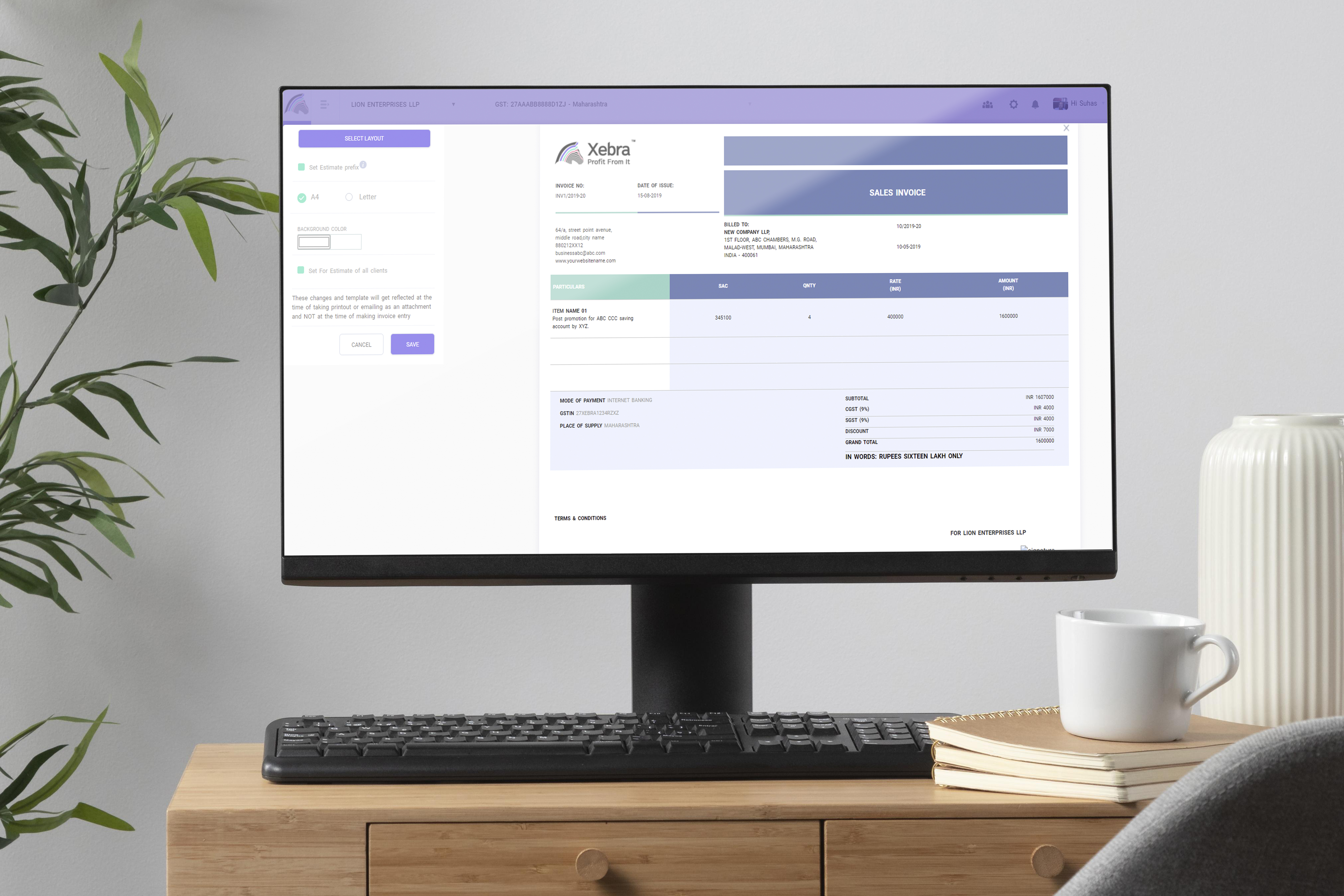

Xebra®: Invoicing and Payments perfected

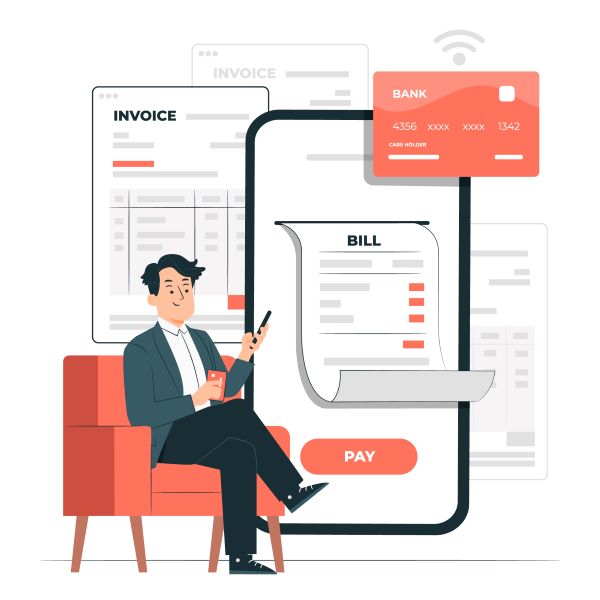

In the whirlwind of managing a small business, one thing stands as a cornerstone of success: seamless invoicing and payment handling. It's the heartbeat of your operation, ensuring a healthy financial flow.

Read More...

Cash Flow Mastery with Xebra®

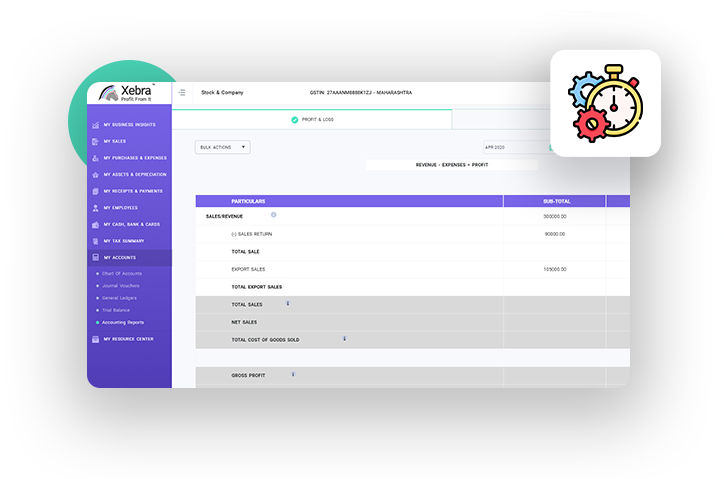

Explore the potential of cutting-edge accounting software such as Xebra®. With its capabilities for delivering real-time insights, automated reporting, and intelligent financial solutions, Xebra® empowers you to take control of your cash flow management. I

Read More...

Empower MSMEs: Xebra® HRMS - Elevate Efficiency

HRMS software is fundamentally a dynamic tool that is redefining how Micro, Small, and Medium-Sized Enterprises (MSMEs) negotiate the challenging landscape of human resource management. Imagine it as the conductor of a symphony, bringing together multiple

Read More...

Unleash Success with the Right ERP Solution

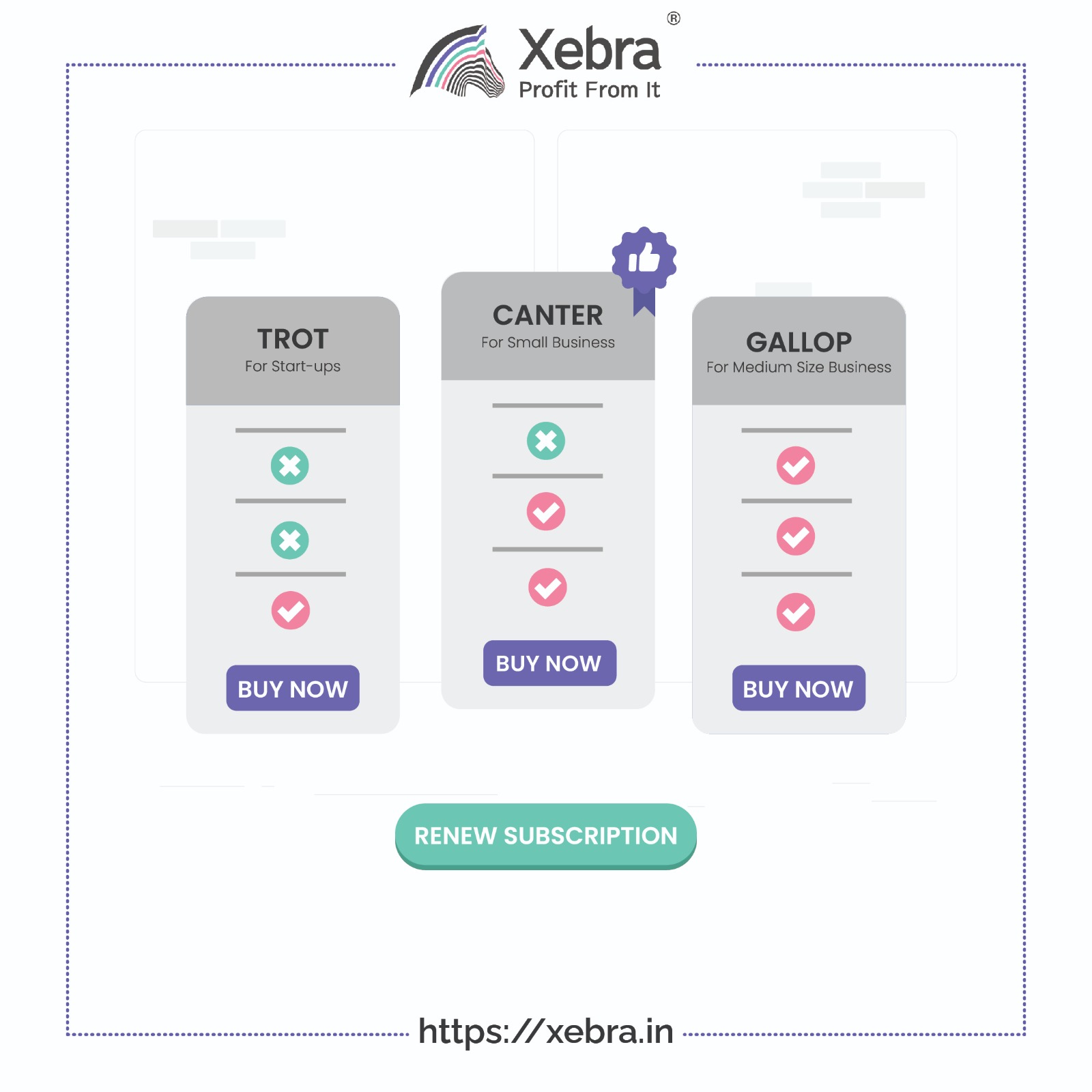

Finding the best ERP software for your small business can be a difficult undertaking. With so many options on the market, it's critical to sort through the intricacies and choose the solution that best meets your needs.

Read More...

Simplify Payments, Automated Invoices Made Easy

Payment and invoicing management is one area that can have a big impact on these elements. Manual processes can be time-consuming, error-prone, and stifle your company's growth. However, with the introduction of automated billing solutions, these difficult

Read More...

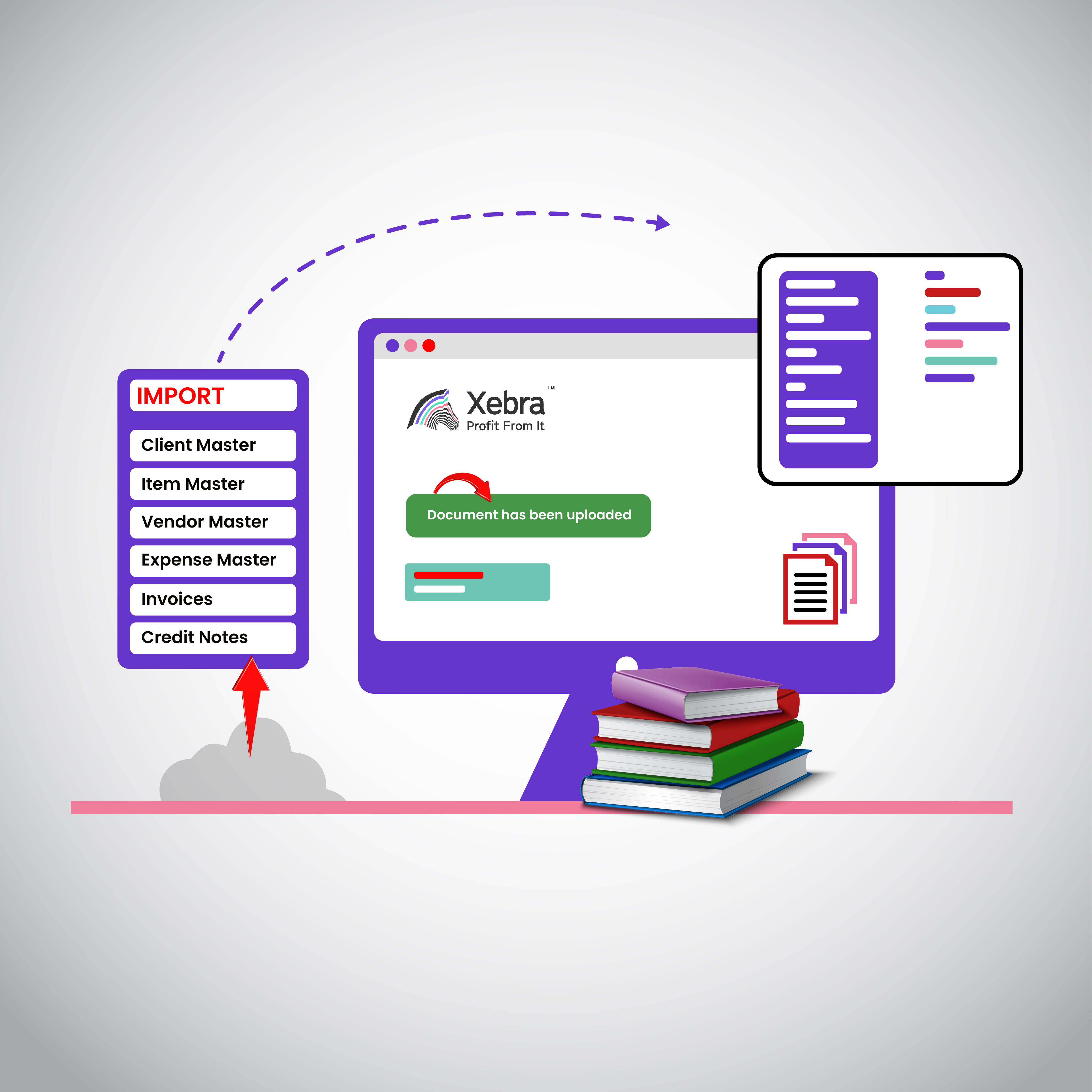

Online GST accounting software: streamlined accounting, tax compliance, efficient record-keeping

Xebra, in my opinion, is the 'go-to' accounting software in India right now. It is India's first Social MSME Business Suite, combining Business Insights, Invoicing, Expense, Purchase, Inventory, Asset, Payroll, HRMS, Bank, Tax, and Accounting modules into

Read More...

Say goodbye to physical storage of documents

In today’s digital world keeping your company documents organized is considered quite a big chore. Because these are critical papers for your business, you must guarantee that they are properly maintained, organised, and kept safe.

Read More...

Step by step guide to kick-start your small business

Covid19 has set back a lot of small businesses since 2020, and I’m sure you decided to read this blog because you are trying to find new innovative ways to save time and money as well as grow your start-up. Almost every individual dreams about starting his

Read More...

Onboarding Simplified for MSMEs

SME processes of today are very different than those of the past, especially since the onset of covid19. As a result of the digital wave, SMEs are among the most zealous adopters of latest technologies like SaaS based cloud accounting softwares.

Read More...

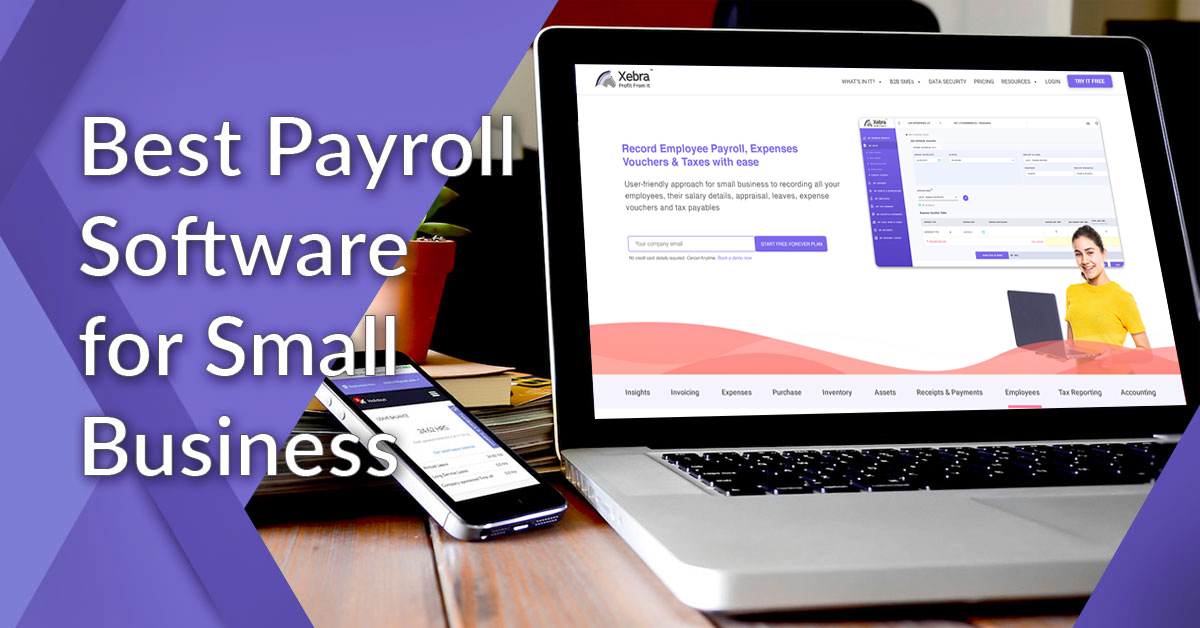

Xebra makes payroll a breeze!

While there are many payroll services providers who are present in India today, if you google for ‘Payroll software providers in India’, it will showcase at least 5,00,000 results to browse through. So with so much information available, how does one choos

Read More...

How does an invoicing software work?

Invoicing software’s are basically online software’s that are made to help businesses get paid faster and function to their uttermost efficiency. It can handle a vast database of your clients and makes your job easy through its smart work and job systems.

Read More...

All You Need to know about Banking Terms

The full form of RTGS is Real Time Gross Settlement, it is a money transfer process that is performed in real-time and without delays. RTGS requires Net Payment which implies that activities are carried out at an individual level without delay and not in b

Read More...

How Cloud Accounting Can Help Small Business

Whether you have one employee or 1,000 employees, whether you are a small business with few employees or a large company with hundreds of employees, it can help you manage all your accounting, financial data and even your customer’s address.

Read More...

This Post Has 0 Comments

Leave a Reply